As the online casino industry grows, Mostbet Casino stands out, especially in India. Known for its enticing bonus offers and wide game selection, it continues to attract countless gaming enthusiasts. This article covers all facets of the Mostbet experience, from registration to mobile app insights.

Overview of Mostbet Casino India

Founded several years ago, Mostbet casino has grown in leaps and bounds, becoming a favorite for many online gaming enthusiasts in India. The casino’s core strength lies in its diverse range of games, easy registration, and enticing bonuses. Whether you’re looking to play mostbet slots or engage in live casino games, the platform has something for everyone. Plus, with the addition of a dedicated mobile app, accessing your favorite games on-the-go has never been easier.

Another highlight of the platform is the enticing Mostbet promo code offers available periodically. These promo codes provide players with an added advantage, enhancing their gaming experience. But, what truly sets Mostbet Casino apart is its no-deposit bonus.

Unlike other casinos where a deposit is mandatory to access bonuses, Mostbet offers unique deals where players can benefit without an initial deposit. As you continue reading, you’ll get insights into how to maximize your gameplay using the bonus options available. Additionally, we’ll touch upon essential aspects such as the download game options, mobile applications, and more.

Mostbet Mobile Apps for Android and iOS

In today’s digital era, a casino without a mobile app is unthinkable. Mostbet Casino, understanding the trend, offers dedicated mobile applications for both Android and iOS devices. With these apps, players can easily sign in, access their favorite games, avail bonuses, and more. Below, we’ll discuss the features of these apps in detail.

For those interested in instant access, the apk is readily available on the official Mostbet website. This ensures secure and quick installation. One of the main benefits of the mobile apps is the ability to play mostbet without the need for a browser. This direct access enhances the gaming experience, reduces lag, and ensures smoother gameplay.

Moreover, the apps come integrated with all features available on the desktop version. Whether it’s accessing the Mostbet promo code, live events, or making transactions, everything is streamlined for mobile use. For those who’ve not yet experienced the mobile version, the following sections will provide a detailed overview of the Android and iOS apps.

Android Version

The Android version of the Mostbet app offers a sleek interface optimized for a variety of devices. Once you download game choices or slots, the app runs smoothly, providing users with an experience akin to the desktop version.

Installing the app is straightforward. Simply head over to the official Mostbet website, locate the apk link, and initiate the download. Given the security protocols of Android devices, ensure you grant necessary permissions for app installations from unknown sources. The app’s design is intuitive, with easy navigation features. Whether you’re looking to sign in, avail a bonus, or play games, the app’s layout makes it effortless.

Regular updates ensure any bugs or glitches are rectified promptly, guaranteeing users a seamless gaming session. And for those on the lookout for exclusive deals, the Mostbet promo code section within the app offers enticing bonuses tailored for Android users. Moreover, all payment gateways are encrypted, ensuring transactions, be it deposits or withdrawals, are safe and secure. Lastly, if you ever face any issues, Mostbet’s dedicated customer support is just a click away, ready to assist Android users round the clock.

iOS Version

For Apple enthusiasts, Mostbet hasn’t held back. Their iOS app, available on the App Store, is a testament to quality and user experience. Players can easily download games, engage in live betting, and more, all with a few taps.

The installation process is straightforward. Simply search for ‘Mostbet Casino’ on the App Store, and click on ‘Get’. Once downloaded, you can sign up or login and delve into the vast gaming library Mostbet offers.

The iOS version, much like its Android counterpart, boasts of an intuitive design. With crisp graphics and smooth animations, playing on an iPhone or iPad elevates the gaming experience to another level.

Security is paramount, and the iOS app ensures all data is encrypted. Whether you’re entering a mostbet promo code, making transactions, or updating account details, rest assured your information is in safe hands.

Furthermore, the app is regularly updated to align with Apple’s guidelines, ensuring compatibility with the latest iOS versions and devices.

Should you face any challenges or have queries, the dedicated support team for iOS users is available 24/7, ensuring uninterrupted gameplay.

Registering an Account

Getting started with Mostbet is a breeze, thanks to its simple registration process. Whether you’re accessing the platform via desktop or mobile, the steps remain consistent and user-friendly. To begin, navigate to the official Mostbet site or app. Locate and click on the ‘Sign Up’ or ‘Register’ button. You’ll be prompted to enter basic details like email, password, and preferred currency.

Post this, users often receive a verification email. Clicking on the verification link ensures your account is active and ready to use. For players keen on availing bonuses right from the start, keep an eye out for the mostbet promo code section during registration. Entering a valid code can fetch you exciting bonuses, elevating your initial gaming experience.

Once registered, you can login, explore the game library, make deposits, and immerse yourself in the world of most bet casino. Remember, ensure you’re of legal age and reside in a jurisdiction that allows online gambling. Mostbet operates under strict regulations, and adherence to guidelines is paramount.

Process of Verification

Verification is a crucial step to ensure the security of both the player and the platform. Mostbet has a systematic and straightforward verification process to authenticate users.

Upon registration, you might be requested to provide specific documents to confirm your identity. This usually includes:

- Government-issued ID (Passport, Driving License)

- Proof of address (Utility bill, Bank statement)

- Proof of payment method (Credit card image, Bank account statement)

Once submitted, Mostbet’s verification team reviews the documents. The verification process typically takes a few business days. Upon successful verification, you’re all set to dive deep into the most bet casino experience.

Logging into Mostbet

Signing in to your Mostbet account is hassle-free. Whether you’re using the desktop site, Android app, or the iOS version, the login procedure remains consistent.

Simply locate the ‘Login’ or ‘Sign In’ button, enter your registered email and password, and you’re good to go. In case you forget your credentials, Mostbet offers a ‘Forgot Password’ feature, allowing users to reset their password swiftly.

| Desktop | Top-right corner > ‘Login’ |

| Android App | Menu > ‘Sign In’ |

| iOS App | Bottom navigation bar > ‘Login’ |

Once logged in, players can seamlessly explore Mostbet ‘s vast game library, live events, and avail exciting bonuses using the Mostbet promo code.

Beginning Your Betting Journey with Mostbet

Embarking on your betting journey with Mostbet is both exhilarating and rewarding. The platform offers an array of games, catering to both seasoned players and newcomers. Whether you’re looking to play mostbet slots, table games, or indulge in live sports betting, there’s something for everyone.

Before diving in, ensure your account is verified and you’ve deposited funds. Mostbet offers various payment methods, facilitating swift and secure transactions.

For players new to online casinos, Mostbet’s ‘Help’ section provides detailed guides on games, betting rules, and strategies. You can also avail a welcome bonus using a special Mostbet promo code, boosting your initial deposit and gameplay.

Remember, always bet responsibly. Set a budget, stick to it, and never chase losses. Online gaming is meant for entertainment; ensure it remains that way.

Live-Cricket Betting

Mostbet ‘s live-cricket betting is a paradise for cricket enthusiasts. Offering real-time stats, odds, and game insights, it’s a thrilling way to be part of the action. The platform covers major cricket events, including the IPL, Ashes, and World Cup.

- IPL (Indian Premier League)

- The Ashes

- ICC World Cup

- T20 Championships

- Domestic Leagues

Betting is easy. Choose an ongoing match, analyze the odds, place your bet, and await the results. With Mostbet’s intuitive interface, even newcomers can navigate through live-cricket betting effortlessly. Plus, you can enhance your betting experience with timely mostbet promo code offers.

Lastly, always stay updated with the game. Real-time stats and game dynamics can significantly influence betting decisions, ensuring you make informed choices.

Live-Events

Beyond cricket, Mostbet offers live betting on various sports. From football, basketball to tennis, the platform covers major sporting events globally. Live-events allow players to place bets during the game, adding an element of thrill and strategy.

Keep an eye on the live scoreboard, analyze game dynamics, and place your bets. With fluctuating odds based on real-time game scenarios, live-event betting at most bet casino is unpredictable and exciting.

Furthermore, for those keen on esports, Mostbet has you covered. Dive into real-time betting on popular esports tournaments and leagues. Whether it’s CS:GO, Dota 2, or League of Legends, immerse yourself in the electrifying world of esports betting.

To keep players engaged, Mostbet frequently rolls out exclusive bonus offers for live-events. Ensure you check the promotions section or look out for a Mostbet promo code tailored for live betting. Conclusively, live-events betting at Mostbet promises thrill, strategy, and lucrative rewards. But, always remember to bet responsibly and enjoy the game!

Mumbai vs Kolkata

One of the most anticipated match-ups in the IPL, the rivalry between Mumbai and Kolkata, is legendary. Both teams have a rich history in the league, with Mumbai having clinched the title multiple times and Kolkata not far behind with their impressive victories.

When these two titans clash, it’s not just a game; it’s a spectacle. The stadiums are packed with passionate fans, each cheering for their respective teams, creating an atmosphere that’s electric and unparalleled.

The strategic prowess of Mumbai, combined with their explosive batting line-up, often sees them as the favorites. However, Kolkata, with their balanced team and game-changers, can turn the match in their favor in a matter of overs.

For bettors, this match-up offers a plethora of opportunities. With fluctuating odds based on each ball and over, live betting during a Mumbai vs Kolkata game can be both thrilling and rewarding. Make sure to stay updated with player forms, team strategies, and weather conditions to make informed bets.

Lastly, for those looking to enhance their betting experience, mostbet promo code often rolls out exclusive offers tailored for big matches like these. So, keep an eye out, place your bets, and enjoy the adrenaline rush that comes with live-cricket betting.

Mobile Version of Mostbet Website

The mobile version of Mostbet Casino is streamlined for user experience. It’s designed to provide swift navigation, ensuring that players can bet and play Mostbet on the go. With its intuitive interface, the mobile site is suitable for all players.

Not only is the mobile version user-friendly, but it also offers seamless integration with the desktop version, enabling a harmonized betting experience. The mobile platform supports all popular sports, live casino, and many more games. This means you never have to miss out on the action, no matter where you are.

One of the standout features of the mobile site is its real-time updates. This ensures that users get the latest odds, allowing them to make informed decisions. With quick login and registration features, new users can easily sign up, while existing ones can sign in without a hitch. For those who love to download games, there’s also the apk, allowing for a more integrated mobile experience.

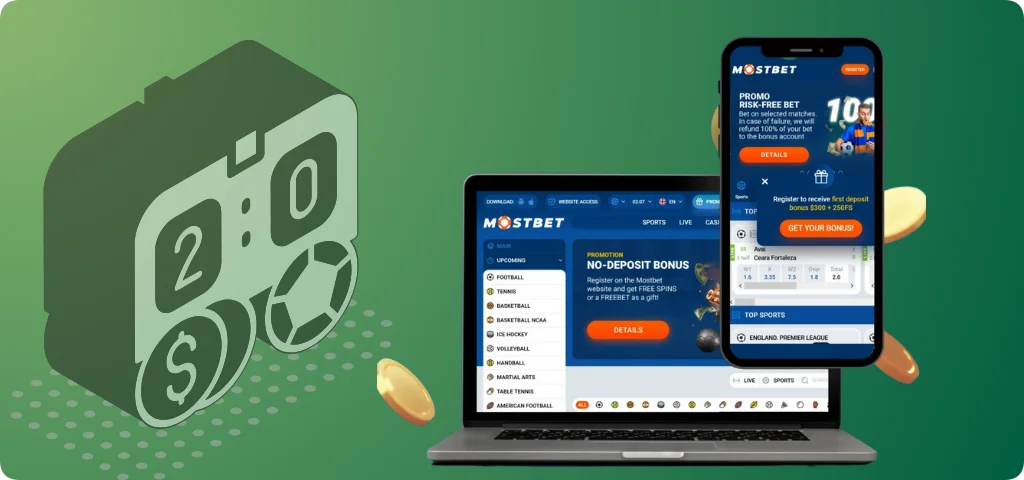

Mostbet Software for PCs (Windows and macOS)

The desktop software of Mostbet Casino boasts superior graphics and a user-friendly interface. Perfect for those who prefer to play on a bigger screen. Compatibility is key. That’s why the software is optimized for both Windows and macOS, allowing for a wide user base.

With simple installation steps, even a beginner can get started in no time. The software includes an auto-update feature to ensure users always have the latest version. From sports betting to live casino, the software supports all the major offerings of Mostbet, presenting them in a clear, organized manner.

For those keen on security, the software employs advanced encryption methods. This ensures that users’ data and transactions remain safe and secure.And of course, the software supports both sign up and login, ensuring quick access for all users.

Promo Code for Mostbet

This year, Mostbet Casino is upping the ante with exciting promo codes. These codes offer users exclusive bonuses and promotions. The Mostbet promo code is designed to reward both new and existing players, ensuring everyone gets a slice of the reward. To use the promo code, simply enter it during registration or in the promotions section of your account.

It’s important to note that promo codes come with terms and conditions. Ensure you read them to understand the requirements, such as minimum deposits or wagering requirements. For players who are always on the lookout for offers, these promo codes can greatly enhance their betting and gaming experience. Keep an eye out on the official Mostbet India website and other promotional platforms for the latest codes.

Welcome Bonuses for Indian Players at Mostbet

Welcome bonuses are a staple of online casinos, and Mostbet Casino India does not disappoint. These bonuses provide an excellent starting point for new players, allowing them to explore without heavily investing initially.

For Indian players, the welcome bonuses at Mostbet are specially tailored to cater to their unique gaming preferences. Registration is the first step to claim these bonuses. Upon successful sign up and login, players can access these rewards in their accounts. The terms and conditions for each bonus are clearly laid out, making it easy for players to understand wagering requirements and other details.

Keep in mind, using a Mostbet promo code might amplify your welcome bonus, giving you an even better start. It’s always a good idea to check the promotions page regularly as Mostbet frequently updates its bonus offers.

Bonus for Sports Betting

Sports enthusiasts are in for a treat. Mostbet offers an enticing sports betting bonus for those who love to wager on their favourite sports. This bonus is a percentage match on your initial deposit, allowing you to bet more with less.

Popular sports like Cricket, Football, and Kabaddi often have specialized promotions, especially during major tournaments. Remember to read the fine print, as there might be minimum odds or specific betting markets to qualify for the bonus. Using the bonus is easy. Once credited, simply place your bets, and the bonus amount will be used proportionally. And don’t forget, timely login and checking promotional emails might give you access to exclusive sports betting bonuses.

Bonus for Casino Games

For those who prefer the thrill of casino games, Mostbet has a special bonus. This includes extra spins on popular slots or bonus funds to play table games. By entering a Mostbet promo code, players can often unlock even more generous casino bonuses. Casino game bonuses are a fantastic way for new players to explore the extensive game library without risking a lot of their funds.

Remember, each game might contribute differently to wagering requirements. For instance, slots usually contribute 100%, while table games might contribute less. Keep an eye out for special game-specific promotions, like exclusive bonuses for newly launched slots or live casino games. Claiming and using the casino bonus is straightforward, giving players an enhanced gaming experience from the get-go.

Accelerated Bonus

An innovative feature, the Accelerated Bonus at Mostbet is for players who love to get their rewards fast. Instead of waiting to meet the wagering requirements entirely, this bonus allows players to claim a portion of their rewards as they make progress. This ensures that players get a constant stream of rewards as they play and bet, enhancing their overall experience.

Do note that the accelerated bonus might have different terms and conditions. It’s always a good idea to familiarize yourself with them before claiming. This bonus type is especially popular among regular players who appreciate instant gratification. As always, having a mostbet promo code might give you better terms or a bigger accelerated bonus.

Deposit and Withdrawal Methods at Mostbet India

Mostbet India offers a wide range of banking methods tailored for Indian players. This ensures smooth transactions, be it deposits or withdrawals.

With Mostbet’s commitment to convenience, players can easily sign in and choose their preferred method. Below is a comprehensive list of available banking options:

- Credit/Debit Cards: Visa, MasterCard

- eWallets: Skrill, Neteller, Paytm

- Bank Transfers: Local bank transfers, IMPS

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin

- Prepaid Cards: Paysafecard

While deposits are typically instant, withdrawal times vary based on the chosen method. Here’s a table showcasing the estimated withdrawal times:

| Method | Estimated Withdrawal Time |

| Credit/Debit Cards | 3-5 Business Days |

| eWallets | Up to 24 Hours |

| Bank Transfers | 3-7 Business Days |

| Cryptocurrencies | Up to 1 Hour |

VIP Rewards and Cashback

Mostbet Casino India acknowledges its loyal players through a prestigious VIP program. By signing up and playing, members can progress through the VIP tiers and enjoy enhanced benefits.

- Silver Tier: Standard cashback, priority customer support

- Gold Tier: Increased cashback, exclusive promotions

- Platinum Tier: Premium cashback, personalized account manager

Each tier comes with its set of rewards. For instance, the higher you climb, the more cashback you receive on your bets, ensuring you get value even on losing bets.

Mostbet ‘s Official Portal in India

The official Mostbet Casino portal in India stands as a testament to the brand’s commitment to providing top-tier betting and casino experiences for Indian players. Let’s delve deeper into the features that make it exceptional. Firstly, the portal is user-friendly with intuitive navigation, making both registration and login processes seamless. The site design resonates with Indian aesthetics, featuring popular sports and games in the region.

Furthermore, with its mobile responsiveness, you can play Mostbet games on-the-go, ensuring uninterrupted gaming sessions, be it on a desktop or mobile device. Moreover, safety remains paramount. The website employs advanced encryption techniques to ensure user data protection and secure transactions. The portal also features a dedicated section for promotions where players can find the latest Mostbet promo codes, bonuses, and offers. This includes the welcome bonus, free spins, and more.

Sports Betting at Mostbet India

One of the prominent attractions of Mostbet India is its diverse sportsbook that covers a range of sports beloved by fans all around the world, especially in India. Whether you are a seasoned bettor or a novice, Mostbet provides an intuitive platform with competitive odds. Let’s delve into some of the most sought-after sports for betting in India.

Cricket

Cricket is not just a sport in India; it’s a religion. Mostbet India fully grasps the nation’s passion for cricket. Bettors can place wagers on a variety of matches, from international tests and ODIs to popular leagues like the IPL. The platform offers in-depth stats, live betting options, and various markets such as top batsman, best bowler, and even predictions for the toss. If you’re looking to play Mostbet and indulge in cricket betting, you’re in for a treat with their extensive coverage.

Kabaddi

Another sport deeply rooted in the Indian culture is Kabaddi. Over recent years, with the inception of leagues like Pro Kabaddi, the sport has seen a significant surge in its fan base. Mostbet India provides a platform for Kabaddi enthusiasts to bet on their favorite teams and players. The website features match outcomes, top raider, and best defender markets, among others, ensuring a comprehensive Kabaddi betting experience.

Football

While Football may have its origins in Europe, its popularity in India has grown exponentially. Mostbet caters to this demand by covering a wide range of leagues and tournaments from the English Premier League to the ISL (Indian Super League). Whether you wish to bet on match outcomes, goals scored, or individual player performances, Mostbet India offers a plethora of options for football enthusiasts. Plus, with live streaming and in-play betting, the excitement is unparalleled.

Tennis

Mostbet India hasn’t overlooked tennis enthusiasts. They offer a comprehensive list of matches from Grand Slams to ATP and WTA tours. Whether you’re rooting for singles or doubles, men’s or women’s tournaments, there’s something for every tennis fan. Live betting options further enhance the experience, allowing punters to place wagers as the match progresses, tapping into the dynamic nature of the sport.

Player-specific bets, set outcomes, and even specific point outcomes are some of the many betting options available. This granularity in choice makes for an immersive betting experience. Moreover, Mostbet frequently rolls out promotions during significant tennis events, wherein players can use the mostbet promo code to avail exclusive offers.

With its user-friendly interface, the platform ensures that tennis statistics, player forms, and historical data are readily accessible, aiding in informed decision-making. For those new to tennis betting, Mostbet India offers a dedicated section with tutorials and tips to get started.

Baseball

While baseball might be more popular in regions like North America, its presence in the Indian betting scene is growing, thanks to platforms like Mostbet India. Offering odds on major leagues like MLB, bettors can sign in and place wagers on their favorite teams and players. From game outcomes to player performances, the betting markets are diverse.

Download games and match highlights are also available, ensuring bettors are well-informed before placing their bets. The platform also provides tips and insights into the game, beneficial for both novices and seasoned bettors. Additionally, the mobile version of Mostbet’s platform allows users to place bets on-the-go, ensuring they never miss out on any baseball action.

Seasonal promotions and bonuses further enhance the baseball betting experience, with special offers rolled out during the World Series and other significant events.

Table Tennis

Often considered a niche in the realm of sports betting, table tennis has seen a surge in interest on Mostbet India. The fast-paced nature of the game offers countless opportunities for live betting.

Whether it’s the international championships or local leagues, Mostbet India presents a plethora of betting options. From match outcomes to specific set results, and even individual player performances, the choices are diverse. The platform’s apk ensures that users can play Mostbet games and place wagers on table tennis matches seamlessly, even while on the move.

For those unfamiliar with the intricacies of the sport, Mostbet offers comprehensive guides and tutorials. These resources, combined with player statistics and match histories, ensure bettors make informed decisions. Regular promotions, especially during significant table tennis events, are the icing on the cake. Bettors can utilize the Mostbet promo code to avail these exciting offers and enhance their betting experience. The registration process on Mostbet is straightforward, allowing even beginners to get started with ease. Once registered, users can sign in and dive into the thrilling world of table tennis betting.

Boxing

Boxing, with its rich history and dramatic in-ring action, is a favorite among many sports betting enthusiasts. Mostbet India caters to this audience with a comprehensive range of betting options. From title fights to undercard bouts, the platform covers events across various weight classes. Whether you’re a fan of heavyweights or lightweights, there’s something for every boxing aficionado.

Bettors can analyze fighter statistics, watch previous match highlights, and even read expert opinions, all within the platform. This holistic approach ensures users place well-informed bets. The thrill of live betting takes the excitement up a notch. As the punches are thrown and the drama unfolds, bettors can place live wagers, tapping into the dynamic nature of boxing. Exclusive promotions and bonuses are frequently on offer, especially during significant boxing events. Using the mostbet promo code, users can access these deals and boost their betting returns. With its user-friendly interface and extensive boxing coverage, Mostbet India is undoubtedly a knockout choice for boxing enthusiasts.

UFC

Mixed Martial Arts (MMA), especially the Ultimate Fighting Championship (UFC), has witnessed a meteoric rise in popularity. Mostbet India, recognizing this trend, offers a vast array of betting options for UFC events. From main card fights to prelims, bettors have a smorgasbord of opportunities. Mostbet’s detailed fighter profiles, which include fight histories, strengths, and recent performances, are invaluable tools for making an informed bet.

Live betting is a significant draw for UFC events. As the rounds progress and strategies evolve, bettors can make real-time wagers, enhancing the viewing experience. For those new to UFC betting, Mostbet offers tutorials and guides. They explain the nuances of the sport and the various betting types available, ensuring that everyone, from novice to expert, can enjoy the experience.

Exclusive promotions tied to major UFC events are common. By using the Mostbet promo code, bettors can capitalize on these offers, making fight nights even more rewarding. With the ease of sign up and the option to download games and events, Mostbet India provides a comprehensive and immersive UFC betting experience.

Basketball

One of the most universally adored sports, basketball, especially the NBA, garners massive interest from bettors worldwide. Mostbet India is no exception, offering extensive coverage of basketball leagues and tournaments. Whether you’re looking to bet on the NBA finals, college basketball, or international leagues, Mostbet has it all. The platform provides in-depth game statistics, player performances, and even team strategies, ensuring bettors have all the information they need.

Live betting during basketball games is a thrilling experience. With the game’s fast-paced nature, odds can change in seconds, and Mostbet ensures that bettors can place their wagers without any hitches. Special bonuses and promotions are often available, especially during playoff season. The mostbet promo code is a gateway to these exclusive offers, enhancing the overall betting experience.

The platform’s apk ensures that users can play Mostbet even on mobile, allowing them to bet on basketball games no matter where they are. With its commitment to providing a top-notch basketball betting experience, Mostbet India stands out as the go-to platform for hoops enthusiasts.

eSports Wagering at Mostbet India

eSports, or electronic sports, refers to competitive video gaming and has seen a massive surge in global popularity. Mostbet India has tapped into this burgeoning market, offering vast betting opportunities on major eSports titles.

Dota 2

As one of the most significant games in the eSports circuit, Dota 2’s global tournaments attract millions of viewers. Mostbet India ensures fans can deeply engage with these events by offering diverse betting options. From predicting overall tournament winners to individual match outcomes, there’s a bet for everyone. The platform’s detailed player and team profiles, coupled with recent performance metrics, make for informed decision-making.

Live betting during Dota 2 matches adds another layer of excitement. With real-time odds reflecting in-game events, bettors can strategize on-the-fly, making the experience immersive. To cater to beginners, Mostbet India offers easy-to-understand guides on Dota 2 betting. Using the mostbet promo code can unlock special bonuses, making tournament season all the more rewarding.

Registration and login processes are streamlined, ensuring fans can quickly dive into the action. The platform’s apk also means users can play Mostbet anytime, anywhere. With the rise of Dota 2 as a titan of eSports, Mostbet India stands poised to offer unparalleled betting experiences for its fans.

LOL

League of Legends (LoL) is another behemoth in the eSports landscape. With its dynamic gameplay and worldwide tournaments, Mostbet India recognizes its potential, offering exhaustive betting options for LoL events. Bettors have access to in-depth game analyses, player stats, and team strategies. These insights, combined with live betting options, ensure an immersive betting experience.

Special events, such as the World Championship, often come with exclusive promotions. By leveraging the Mostbet promo code, bettors can avail these bonuses, enhancing their overall experience. For newcomers, Mostbet offers tutorials and insights on LoL betting. The platform’s commitment to ensuring a seamless sign in and betting process makes it a top choice for many. Whether you’re a seasoned bettor or just starting, Mostbet India’s extensive coverage of League of Legends ensures you’re always in the thick of the action.

CS:GO

Counter-Strike. Global Offensive (CS.GO) remains a staple in the eSports industry, boasting a vast player base and viewer audience. Mostbet India offers fans a chance to engage with their favorite CS.GO events more deeply through diverse betting opportunities. Bettors have access to detailed match analyses, team line-ups, and player performance metrics, making for an informed betting journey. From predicting the victor of knife rounds to the total rounds in a match, the betting types are comprehensive.

The global tournaments and regional leagues offer numerous matches to bet on. Using the Mostbet promo code, bettors can avail special bonuses during major CS.GO events. For beginners, Mostbet India provides easy-to-understand guides on CS:GO betting. Coupled with the seamless registration and login process, even novices can start betting in no time. With live betting options, Mostbet India ensures that the thrill of a CS:GO match remains intact. Real-time odds adjustments reflecting on-ground events make for a dynamic betting experience. Given the legacy and popularity of CS.GO, it’s no wonder that Mostbet India places significant emphasis on offering top-tier betting options for this game.

StarCraft 2

StarCraft 2, a real-time strategy game, has been a cornerstone of eSports for a decade. Mostbet India capitalizes on its legacy, offering broad betting opportunities for various StarCraft 2 tournaments. With a global following, StarCraft 2 tournaments see players and teams battling it out for supremacy. Mostbet provides in-depth stats and match analyses, aiding bettors in making informed decisions.

The platform’s regular promotions, especially during premier events like the World Championship Series, offer lucrative opportunities. By entering the Mostbet promo code, users can unlock these exclusive bonuses. New to the realm of StarCraft 2 betting? Mostbet India has got you covered. With detailed guides and insights, even beginners can quickly grasp the nuances and start betting.

StarCraft 2’s intricate gameplay, combined with Mostbet’s comprehensive betting options, ensures fans have a front-row seat to all the action, amplifying the excitement manifold.

Wagering on Simulated Sports

Simulated sports have risen in popularity, providing a consistent avenue for enthusiasts to place bets irrespective of real-world sports calendars. At Mostbet India, a diverse array of these virtual sports is available for fans. These virtual matches simulate real-life games but run on algorithms and random number generators. The advantage is their immediate nature; they don’t rely on real-world events, enabling continuous betting opportunities. Bettors can easily sign up, login, and dive into the action.

The beauty of simulated sports lies in its consistency and unpredictability, ensuring a level playing field for both newbies and seasoned bettors. Another advantage? The results are quick, ensuring bettors don’t have to wait for prolonged durations to know the outcome of their stakes.

Whether you are into football, horse racing, or tennis, Mostbet Casino’s simulated sports section has something to cater to everyone’s tastes. The graphics and animations are top-notch, enhancing the overall betting experience. For those who want to play Mostbet simulated sports, the platform provides easy registration and a plethora of betting options. With regular promotions and the occasional Mostbet promo code, bettors can avail additional benefits.

Top Betting Selections at Mostbet India

Mostbet India has rapidly grown to be a favorite among betting enthusiasts, primarily because of its wide variety of betting options that cater to both seasoned bettors and novices alike. With a user-friendly interface and a plethora of markets to choose from, the platform ensures an enriched betting experience. Let’s delve into two of the top betting selections at Mostbet India.

Betting As Events Happen

In-play betting, often known as live betting, has revolutionized the way punters place bets. Mostbet India offers a robust platform for those who prefer betting as events unfold. The dynamic odds adjust in real-time based on the progress of the match, giving punters the opportunity to capitalize on the game’s momentum. Whether it’s a sudden goal in a football match or an unexpected wicket in cricket, in-play betting at Mostbet ensures you’re always part of the action. The real-time stats and live streaming services further enhance the experience, allowing bettors to make informed decisions on the fly.

Bets Before Matches Start

For those who prefer the traditional method of betting, Mostbet India offers comprehensive pre-match betting options. Punters can research teams, analyze stats, and make predictions well before the event begins. This gives them ample time to strategize and choose from a wide range of markets – from outright winners and top scorers to more nuanced bets such as the number of corners in football or total runs in a cricket over. Betting before the match starts allows for a more calculated approach, often based on extensive research and analysis, and Mostbet provides all the tools and information needed to make those predictions as accurate as possible.

Whether you’re the type who trusts your instincts in the heat of the moment or one who likes to meticulously plan out your bets, Mostbet India has got you covered. Their diverse betting selections ensure that every punter finds their niche and enjoys a rewarding betting journey.

Different Betting Styles

Understanding the types of bets is crucial for anyone looking to engage in betting at Mostbet India. Each style caters to a different kind of strategy and risk appetite. When you sign up and login to Mostbet, each style comes with its distinct set of odds and potential payouts. Here’s a table illustrating potential returns for each bet type, assuming a base stake:

| Bet Type | Description | Potential Return (INR) |

| Single Bets | One event, one outcome. | Varies with odds |

| Accumulated Bets | Multiple events combined. | Increases with each added event |

| Combined Bets | Several events, flexible outcomes. | Dependent on number of outcomes |

Single Bets

At the heart of betting lies the concept of Single bets. As the terminology indicates, a single bet is the act of staking money on a singular outcome within an event. This could range from rooting for a specific team to clinch victory in a game, to wagering on an athlete to achieve a particular performance metric. The primary allure of single bets is encapsulated in their uncomplicated nature. They stand out as the ideal starting point for those venturing into the betting realm for the first time. The ease with which punters can decipher potential profits is a notable merit, and more often than not, the associated risk is relatively subdued, especially when juxtaposed against intricate betting modalities.

Accumulated Bets

Branching out from single bets, we have accumulator bets, colloquially termed “accas.” This betting style is characterized by amalgamating several single bets into a unified wager. The defining trait of accumulated bets is the cumulative nature of the odds – the odds of each constituent bet are multiplied, paving the way for potentially magnified returns.

However, this method comes with a caveat. for the accumulator to yield a positive outcome, every individual prediction nestled within must hit the mark. This inherent riskiness of accas is counterbalanced by the tantalizing prospect of augmented rewards. Within the corridors of Mostbet India, it’s commonplace for bettors to leverage accumulated bets, particularly when their focus is on events with relatively modest odds, aiming to amplify their prospective gains.

Combined Bets

Fusing the elements of both single and accumulator bets, we arrive at Combined bets. Occasionally dubbed as system or parlay bets, combined bets present punters with the flexibility of making an array of selections. However, they deviate from accumulators in one fundamental aspect: not every selection necessitates accuracy for a payout. To illustrate, in a combined wager encompassing four events, a punter could still reap returns even if a solitary prediction goes awry. This modality strikes a harmonious chord between potential risks and rewards, offering bettors a semblance of a safety cushion, a feature absent in conventional accumulator bets.

In the intricate tapestry of sports betting, aligning oneself with the apt betting style can be the key to unlocking a rewarding experience. Whether one’s inclination leans towards straightforwardness, the allure of substantial returns, or a harmonious blend of both, Mostbet India stands poised to offer an eclectic mix of betting alternatives, tailored to satiate the diverse palette of every betting enthusiast.

Understanding Betting Odds

The odds at Mostbet Casino are not just numbers; they represent probabilities. They give you an idea of how much you can win on your bets. Essentially, odds are the ratios of amounts staked by parties in a bet.

For beginners, it’s crucial to understand that betting odds serve two purposes:

- They reflect the likelihood of a particular outcome happening.

- They show the potential profit on a bet.

When you play Mostbet, it’s beneficial to use the platform’s tools and resources, ensuring you make informed decisions. While registration is straightforward, understanding odds might require a bit of practice and patience.

For instance, if a cricket match has odds of 2.50 for a team winning, it means for every 100 INR bet, your potential profit is 150 INR (total return of 250 INR).

With the plethora of events to bet on, from sports to casino games, it’s easy to see why Mostbet remains a top choice for many. Their transparency in odds and the frequent bonus offers only enhance the experience.

Watch Live Events at Mostbet India

One of the standout features of Mostbet India is the ability to watch live sports events directly on the platform. This immersive experience not only offers entertainment but also aids bettors in making real-time decisions.

When you sign in to your account, you’re presented with an array of ongoing matches across different sports. Here’s how it enhances your betting experience:

- Real-time match insights help you place informed bets.

- Immediate updates on scores, statistics, and player performances.

- Instant notifications about any changes during the live event.

Many users claim that the live streaming feature is one of the reasons they prefer to play Mostbet . It’s also worth noting that the video quality is adjustable, ensuring a seamless experience irrespective of internet speed.

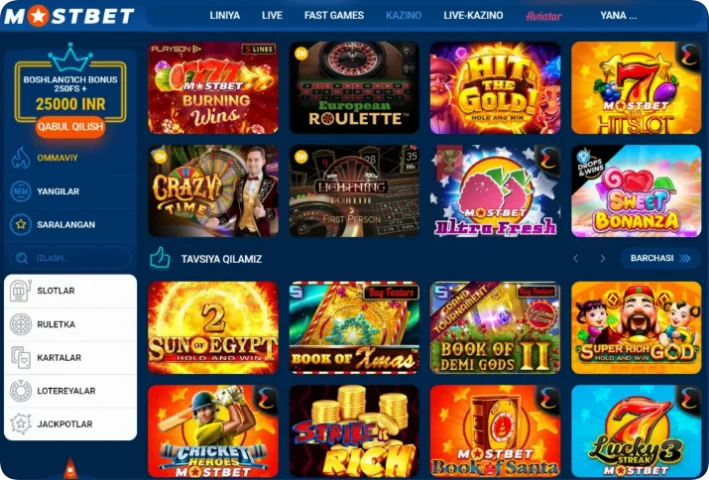

Casino Gaming at Mostbet

The experience at Mostbet Casino goes beyond traditional sports betting. For those who enjoy the thrills of a casino, there’s an expansive array of games to dive into. From classic table games to the latest slots, the platform caters to all types of casino enthusiasts.

To download games or access them directly from your browser, follow the simple steps after registration. A key highlight is the live casino feature, bringing the real-world casino experience right to your screen.

- Slots: A vast collection from leading game providers. Whether you love traditional fruit machines or modern video slots, there’s something for everyone.

- Poker: Test your strategy against players from around the world. Various poker rooms cater to different skill levels.

- Blackjack and Baccarat: Classic card games that remain ever-popular. Play against the dealer and test your luck.

- Roulette: Whether you prefer European, American, or French versions, the spinning wheel awaits.

With regular promotions, bonus offers, and a Mostbet promo code now and then, the casino gaming experience at Mostbet remains unparalleled. Also, with the apk available for download, gaming on the go has never been easier.

Must-Play Casino Games at Mostbet

The Mostbet Casino platform boasts a plethora of casino games that have garnered significant attention in the gaming community. These are the games that both newbies and seasoned players keep returning to.

Slots

Arguably the most diverse category, slots at Mostbet Casino offer endless themes and gameplay styles. Whether you’re looking for vintage 3-reel slots or modern 5-reel adventures, there’s a perfect fit waiting for you. Ensure you make use of the mostbet promo code to amplify your slot experience with additional bonuses.

Poker

For those who love strategy and competition, poker tables at play Mostbet present a compelling challenge. Several variations of the game ensure that players can pick according to their proficiency. Remember to sign up for poker tournaments to stand a chance to win bigger payouts.

Baccarat

A classic card game that’s a hit among high rollers, Baccarat at Mostbet India is both engaging and rewarding. With simple rules and a touch of strategy, it’s a game that keeps players on the edge of their seats.

Blackjack

Counting to 21 has never been more thrilling! At Mostbet’s blackjack tables, players can enjoy multiple versions of the game, each offering a unique twist. Whether you’re a newbie or a blackjack veteran, there’s a table for you.

Roulette or European Roulette

Place your bets and watch the wheel spin! Roulette at Mostbet offers various betting options, from straightforward number bets to complex combinations. The European version, with a single zero, offers better odds for players.

Games with Jackpot Prizes

For those chasing life-changing wins, the jackpot games section is where fortunes are made. Popular titles frequently feature prizes that run into millions. Just a single spin can transform a player’s life!

- Lucky Jet: A modern slot with frequent payouts and a soaring jackpot.

- JetX: Combining elements of classic and video slots, this game’s jackpot keeps players returning.

- Aviator: Themed around the golden age of aviation, its jackpot is sky-high!

- Rocket X: A space-themed slot where the jackpot is truly out of this world.

- Plinko: A unique game combining slots and board game mechanics, where the jackpot drops can be massive.

To ensure uninterrupted gaming, Mostbet also offers an easy-to-navigate apk for download. With swift registration and login processes, players can dive right into the action!

Top Casino Games at Mostbet

In the vast world of online entertainment, casino games have carved a unique space, blending the thrill of chance with strategic decision-making. From the neon lights of virtual slot machines to the sophisticated strategies of digital card games, online casinos offer a diverse range of experiences that cater to both seasoned gamblers and newcomers alike.

As technology advances, these platforms have evolved, offering more immersive and realistic experiences that transport players to the heart of Las Vegas or Monaco without ever leaving their homes. In this guide, we’ll explore some of the top casino games, highlighting the features that make them stand out in an ever-expanding digital gaming landscape.

Lucky Jet

As one of the most popular games at Mostbet, Lucky Jet has captivated players with its thrilling gameplay and potential for substantial wins. Seamlessly blending classic casino elements with innovative features, it offers a gaming experience that is both familiar and refreshingly new.

JetX

JetX stands out with its unique mechanics and engaging visuals. Players are taken on a high-flying adventure, where strategic bets and timely decisions can lead to impressive rewards. Its rising popularity underscores its position as a must-try game on the platform.

Aviator

Drawing inspiration from the world of aviation, “Aviator” challenges players to navigate through exhilarating rounds, betting on outcomes that can lead to sky-high payouts. Its immersive graphics and sound effects further enhance the overall gaming experience.

Rocket X

Ready for liftoff? Rocket X propels players into space, where they aim to accumulate wins as they soar through the cosmos. The game’s dynamic nature ensures that no two rounds are the same, making every session a unique journey.

Plinko

Bringing a classic game show favorite to the digital realm, Plinko at Mostbet is all about strategy, luck, and anticipation. Players release a chip from the top and eagerly watch as it bounces through pegs, hoping it lands in a lucrative slot. The game’s simplicity, combined with its potential for big wins, has made it a beloved choice among the community.

With such a diverse lineup, it’s clear why Mostbet has become a premier destination for casino enthusiasts. Each game offers a distinct experience, catering to a wide range of preferences and playstyles.

Real-time Casino Gaming

Real-time casino gaming has been a game-changer in the world of online gambling. Unlike traditional online games, real-time gaming offers the authentic experience of a brick-and-mortar casino, right from the comforts of one’s home. It bridges the gap between virtual and physical gaming, providing a platform for players to interact with live dealers and other participants.

Mostbet Casino, or often referred to as most bet casino, has excelled in offering top-notch live casino experiences. Their state-of-the-art technology ensures smooth streaming, clear graphics, and real-time interactions, replicating the vibrant atmosphere of a physical casino.

From classic card games to popular table games, there is a broad spectrum of live casino games for players to explore. With live dealers guiding the sessions, participants can sign up and immerse themselves in the real-time action, making decisions on the go and engaging in friendly banter.

Furthermore, the convenience to play Mostbet games without having to step out is particularly appealing to many. With safety measures in place, secure transactions, and instant feedback, it’s no wonder that many prefer the live casino section of Mostbet India.

For those new to this form of gaming, Mostbet also offers guides, FAQs, and customer support, ensuring that even beginners feel at home. Players can login, choose their preferred game, and dive straight into the world of real-time gaming.

Additionally, keep an eye out for the mostbet promo code, which can offer exclusive bonuses and special access to live casino events, enhancing the overall gaming experience.

Digital Lottery Games

The thrill of lottery games is timeless. With the anticipation building up to the moment the numbers are revealed, the adrenaline rush is unparalleled. Mostbet Casino has tapped into this excitement by introducing digital lottery games, allowing players to test their luck any time they wish.

These games, often available after a quick registration at Mostbet , offer a digital twist to traditional lottery. With random number generators ensuring fairness, players can rest assured about the game’s integrity.

Several variations are available, catering to different preferences. Whether it’s a quick game or a prolonged draw, Mostbet ensures that there’s something for everyone. The convenience of participating in a lottery from a mobile device or desktop has made it a favorite among many.

Mostbet often runs special promotions and bonuses for their lottery games. Using the right mostbet promo code can give players extra tickets or increased odds of winning. It’s always a good idea to stay updated with their offers.

For those unfamiliar with digital lotteries, Mostbet offers comprehensive guides and customer support to assist. The platform encourages players to play responsibly and offers tools and guidelines to ensure a healthy gaming experience.

Overall, digital lottery games at Mostbet Casino are an excellent way to experience the classic thrill of a lottery, but with a modern touch and at one’s convenience.

Televised Gaming Sessions

Televised gaming sessions at Mostbet Casino take the gaming experience to a whole new level. By merging the thrill of live television with the exhilaration of gaming, these sessions offer a unique and captivating experience for players.

One of the highlights of these sessions is the opportunity to witness games being played in real-time on TV, while simultaneously participating online. This dual-experience enhances trust and transparency, as players can see everything that’s happening.

Mostbet India’s curated list of televised games includes:

- Live Blackjack: Watch the dealer shuffle and deal in real-time on your TV screen.

- Roulette Royale: See the roulette wheel spin and anticipate where the ball might land.

- Poker Sessions: Televised tournaments where you can play mostbet poker and witness the action unfold on screen.

- Bingo Extravaganza: A fun-filled session with numbers being called out live on TV.

- Special Game Shows: Interactive sessions that merge the thrill of game shows with the excitement of casino gaming.

To participate in televised gaming sessions, players typically need to sign in to their Mostbet account, choose the desired game, and follow the on-screen instructions. It’s a seamless experience, enhanced by the opportunity to grab bonuses and special offers using the mostbet promo code.

Checking Match Outcomes and Data

Ensuring transparency and trustworthiness, Mostbet Casino offers players an easy and convenient way to check match outcomes and game data. This feature is pivotal, especially for those who indulge in sports betting and want to verify results.

Key data and outcomes you can check include:

| Game Type | Data Available |

| Sports Betting | Final scores, match statistics, player performances. |

| Live Casino | Game outcomes, dealer actions, winning numbers in roulette. |

| Slots | Spin outcomes, jackpot hits, bonus rounds triggered. |

| Digital Lottery | Drawing results, number frequencies, jackpot winners. |

To check outcomes, players usually need to navigate to the ‘Results’ or ‘History’ section post login. Additionally, the platform ensures that all game outcomes are generated through fair and random processes, emphasizing their commitment to integrity.

Reach Out to Mostbet: Support and Contacts

Mostbet Casino, with its dedication to user satisfaction, offers robust customer support to address queries and concerns. Whether it’s a question about a bonus, difficulties during registration, or issues with a download game, their team is always ready to help.

Ways to get in touch with Mostbet:

- Email: Typically used for non-urgent queries and feedback.

- Live Chat: Ideal for immediate assistance. Accessible right after you sign in.

- Phone: For those who prefer talking directly with a support agent.

- Help Center: A comprehensive section with FAQs, guides, and step-by-step tutorials.

It’s noteworthy that the support team understands the nuances of the Indian market, ensuring that users from India feel right at home. Furthermore, they frequently offer guidance on how to optimize the use of the Mostbet promo code and other incentives.

Why Indian Users Prefer Mostbet

Mostbet Casino has carved a niche for itself in the Indian gaming landscape. But what factors have contributed to its soaring popularity?

Here are the primary reasons:

- Localized Gaming Experience:Mostbet Casino offers games that resonate with the Indian audience, including local favorites and adaptations of traditional games.

- Convenient Transactions:The platform supports INR, and users can both deposit and withdraw funds without any currency conversion hassles.

- Generous Bonuses:From a hefty welcome bonus to periodic promotions, Indian players have many opportunities to boost their bankroll. This includes offers that can be availed using the mostbet promo code.

- Mobile Gaming.With the Mostbet apk available for download games, gaming on the go has never been easier.

Attractive Bonus Offers

Mostbet Casino excels in offering attractive bonus deals to its users. New players can benefit from a substantial welcome offer, while regulars can avail of periodic promotions, cashback offers, and more. The best part? Many of these can be accessed using the exclusive mostbet promo code.

Some of the bonuses include:

- Matched deposit bonuses.

- Free spins for select slots.

- Cashback offers for live casino games.

- Special bonuses for sports betting enthusiasts.

It’s essential to read the terms and conditions linked to each bonus, ensuring that you meet the wagering requirements and maximize the potential benefits.

The Official Mobile App

For those who enjoy gaming on the go, Mostbet Casino offers a streamlined mobile experience through its official app apk. Whether you’re looking to play Mostbet slots, table games, or place sports bets, the app provides a seamless experience.

Key features of the mobile app:

- User-Friendly Interface: An intuitive design ensures that both new and seasoned players can navigate with ease.

- Quick login and sign up Process: Get started with your gaming journey in just a few taps.

- Secure Transactions: Deposit and withdraw funds with the same security measures as the desktop version.

- Exclusive Offers: Mobile users sometimes get exclusive bonuses and promotions. Ensure to check the mostbet promo code section regularly.

Swift Transaction Processes

One of Mostbet Casino’s strengths lies in its efficient transaction processes. Players can quickly sign in, make a deposit, enjoy their gaming session, and then withdraw their winnings without any hitches.

Popular transaction methods at Mostbet India:

- Credit and Debit Cards

- Online Bank Transfer

- E-wallets like Skrill and Neteller

- UPI (Unified Payments Interface)

Attentive Support Team

At Mostbet, players can always count on the support team to assist with any inquiries. From questions about registration to understanding the latest bonus offers, the team provides timely and accurate responses.

Channels to reach the support:

- Email support for detailed inquiries.

- Live chat for instant solutions.

- A comprehensive FAQ section for self-help.

Licensing and Oversight of Mostbet

Security and trust are paramount in online gaming. At Mostbet Casino, players can rest assured, knowing the platform operates under stringent regulatory guidelines. Their licensing from reputable bodies ensures fairness, transparency, and the highest levels of security.

Furthermore, the platform employs advanced encryption protocols, ensuring players’ data and financial transactions remain confidential and secure.

Important Guidelines

Engaging with any online platform comes with responsibilities. Mostbet Casino encourages responsible gaming and provides tools and guidelines to help players enjoy their sessions without falling into problematic behaviors.

Some recommended practices include setting deposit limits, taking regular breaks, and being aware of the time and money spent on the platform. Players are also advised to be aware of the terms and conditions associated with bonuses, especially when using a mostbet promo code.

Summary

In the rapidly evolving landscape of online gaming, Mostbet Casino has carved a niche for itself, especially among the discerning Indian gaming community. What sets it apart is its rich tapestry of gaming options that beautifully marries the charm of time-honored traditional games with the thrill of contemporary ones. This unique amalgamation ensures that players, regardless of their preferences, find something that resonates with them.

But the allure of Mostbet Casino doesn’t stop at its diverse gaming library. The platform stands tall with its state-of-the-art technology, ensuring a seamless and immersive gaming experience for users. Its user-friendly interface, coupled with lightning-fast response times, makes for an unparalleled gaming journey.

One of the standout features of Mostbet Casino is its generosity. The casino rolls out a plethora of bonuses, promotions, and special offers, making sure that players always feel valued. Whether it’s a sign-up bonus for newcomers or loyalty rewards for long-standing members, there’s always a token of appreciation awaiting players.

Another cornerstone of Mostbet Casino’s success is its unwavering commitment to customer satisfaction. Their dedicated customer service team, always ready to assist, is a testament to this. Whether it’s a query, concern, or feedback, the attentive team ensures that every player’s issue is addressed promptly and efficiently.

Moreover, in an era where responsible gaming is of paramount importance, Mostbet Casino takes its commitment seriously. They have stringent measures in place to ensure that gaming remains a source of entertainment and doesn’t devolve into an addiction. This focus on player well-being, coupled with their transparency in operations, fosters a sense of trust among the player base.